State Compliance Guide

How to successfully navigate state and local labor regulations

Introduction

Proposed state and local labor regulations are adding to already challenging federal rule compliance.

Managing compliance with federal labor laws is difficult enough for HR and payroll managers given constantly changing regulations and the ongoing list of pending legislation. Add individual state and local labor requirements to that mix and it’s no wonder that those responsible for maintaining compliance and processing payroll within their organization shake their heads and struggle to keep up.

If you are moving your organization to a new area or are kicking off operations in a locale where you haven’t done business before, it’s important to make sure you know what you’re getting into. There are six major employment areas that can easily trip up business leaders when their organizations venture into new locations or states. Read on to learn what you need to know about the labor laws in certain areas, how you can ensure your operation is following all labor law regulations, and how to make the right business decisions regarding your employees to ensure they’re accurately paid.

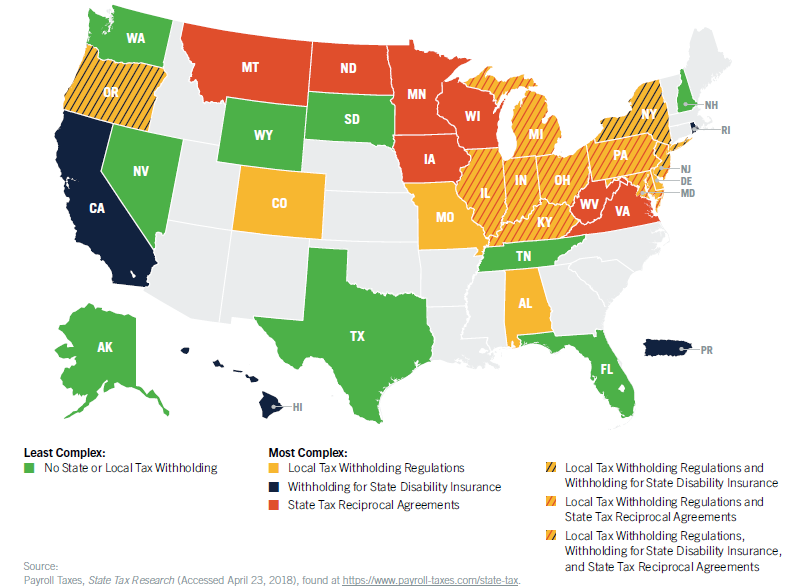

State and Local Tax Withholding and Reciprocity

Withholding state and local taxes from employee pay sometimes can be tricky.

When an employee works in one city or state but lives in another, reciprocity agreements may allow an employer to withhold taxes based on residency, not on work location. Knowing which states or cities allow this and which don’t can be overwhelming. If your organization has operations in any of the states with complex withholding or reciprocity regulations, then you need to pay special attention to these regulations.

MAKING TECHNOLOGY WORK FOR YOU

Don’t be faced with fees, fines, and penalties for not complying with tax agency requirements. Invest in technology that understands the complexities of tax withholding and remitting. Alleviate the burden of managing to different

regulations by using modern payroll technology. You can distinguish taxation based on employee residency and work locations — and handle multistate taxing. And when your payroll and timekeeping systems are on a single platform, capturing accurate time- and location-worked information becomes a seamless process. Using the technology, you can easily withhold the correct amount from each employee’s paycheck and remit the appropriate amount to each taxing agency.

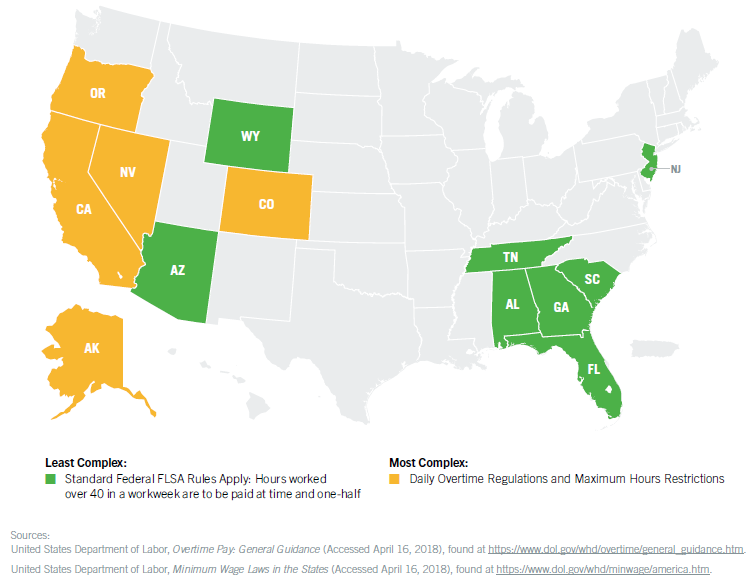

Overtime Complexities

Inaccurate overtime tracking and calculations can lead to noncompliance penalties.

Although tracking employee wages and overtime can be challenging, it’s critical for employers to understand pay

rules and how they impact not only an employee’s pay but also the organization through the imposition of possible fines, fees, and penalties for noncompliance. Most states follow the federal rules set forth under FLSA (Fair Labor Standards Act), but there are exceptions. While no state can require less than the federal FLSA rules, states can create more employee-friendly regulations. These exceptions can quickly create issues for an employer.

MANAGING OVERTIME COMPLEXITIES

A number of technology tools can help manage complex overtime policies. A versatile pay rules engine used in timekeeping software can simplify the process of determining pay associated with regular and overtime hours. A modern timekeeping system can support any number of scenarios to accurately track worked time, such as shift differentials, order of importance, daily and total hours worked, and more. Solutions can even send out alerts and notifications when employees are approaching hours-worked and overtime thresholds. These tools can help you better manage your employees and labor costs to meet your business and customer needs — and maintain compliance.

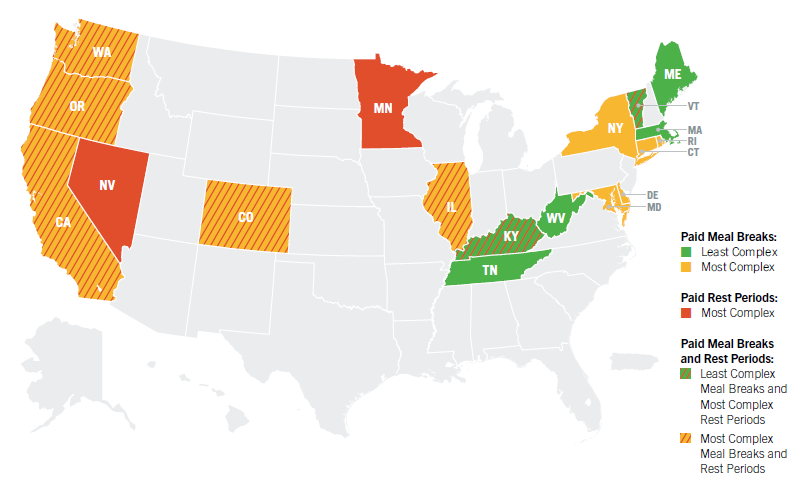

Meal and Rest Breaks

Varying meal and rest break rules can be complex and create confusion.

While no federal legislation requires employers to adhere to a minimum time for meals or rest periods, individual states have a variety of rules on the books. Meal policies can range from an optional 30-minute meal or rest break after five continuous hours to complex policies and laws that require a minimum of 30 minutes of uninterrupted time after five hours worked — as well as penalties if time is not provided or an employee took less time than required. Depending on industry or trade, even more restrictions may apply.

Likewise, rest periods vary from state to state, with some states simply allowing for 30 minutes of rest or a meal after five hours worked, or as little as five minutes of rest for every four hours worked. To add to the confusion, some states distinguish between paid breaks and non-paid breaks by the amount of time an employee takes while on break.

CONSISTENTLY APPLY MEAL AND REST BREAK RULES

Each state has its own set of requirements for specific worker types that an employer must follow or risk costly fees, fines, and penalties. Having accurate employee schedules is a starting point, and coupling this with the pay rules engine in your timekeeping solution provides the necessary automation and adherence to varying and complex work and pay rules. The advantage of modern technology is building the rules and parameters once, and with

centralized policy and rule configuration in the solution, knowing that the same set of rules will apply to all employees assigned to a job category.

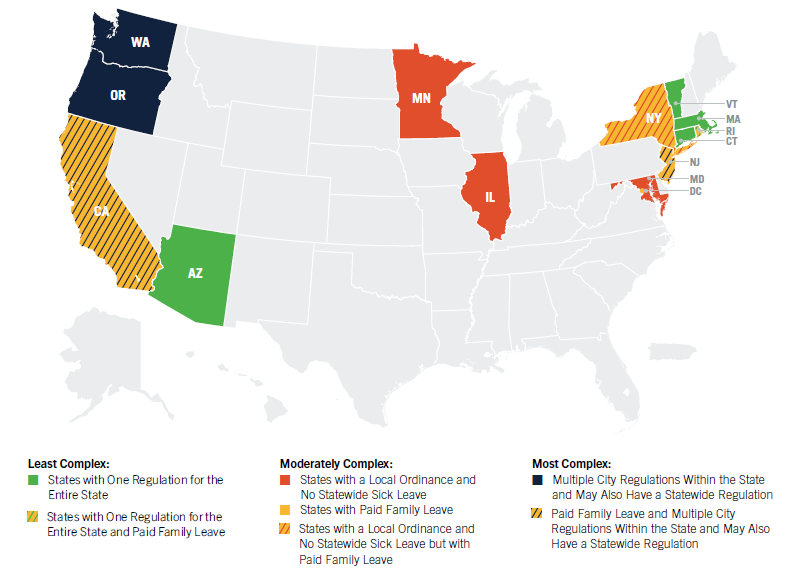

Paid Leave Laws

Changing paid leave laws bring new rules that can be difficult to apply manually.

In the absence of federal regulations, a growing number of states and local jurisdictions have passed paid sick leave laws. In addition, paid family leave is gaining strength and adds more complexity to tracking leave. Each new law can have its own rules and restrictions, requiring that each set of rules that applies to your state or local jurisdiction be incorporated into your HR/payroll system. For employers with operations in multiple states, this can be challenging, as they aren’t able to operate under a single set of rules. This can cause confusion for employees and makes it difficult for organizations to streamline configurations within their HR/payroll systems.

AUTOMATE PAID LEAVE LAW COMPLIANCE

When faced with managing and staying abreast of frequent leave law changes, investing in a unified solution with a single integration — and employee record — for HR to timekeeping to payroll is the smart choice. Tracking and accruing the correct leave amounts, per policy, can quickly become overwhelming without automation and centralized policy control. Your HR and leave software should be able not only to track and accrue, but also generate action letters based on policies, provide alerts when thresholds are met, and be flexible enough to meet varying rules based on company and legal requirements. Ensure your employees have the right amount of leave to take at the right time, and have confidence you are meeting all your compliance obligations.

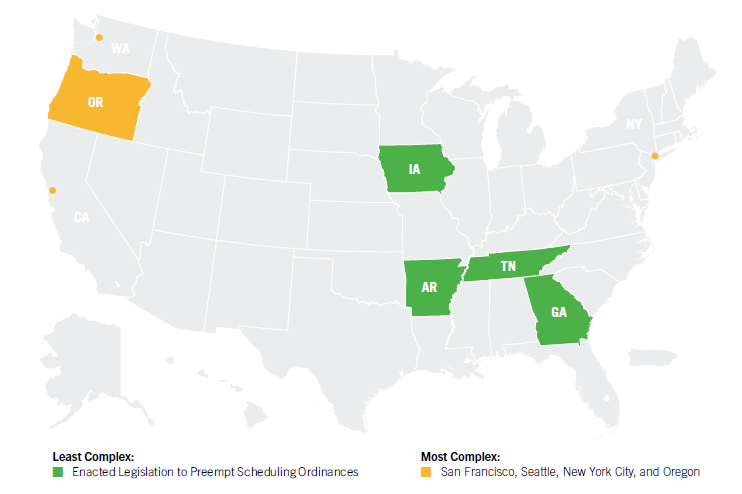

Predictive Scheduling and Fair Workweek

Meeting predictive scheduling legislation requirements can be daunting with manual processes.

Predictive scheduling laws generally affect the retail, hospitality, and food service industries and are being

enacted to give employees predictable schedules that foster better work-life balance and greater financial stability. For employers, however, accurately forecasting customer traffic and demand weeks in advance to meet predictive scheduling requirements can be nearly impossible with manual processes. The result can be overstaffing, leading to additional labor costs, or understaffing, creating overwhelmed employees and unhappy customers. And the

last-minute schedule changes typical in these industries can create scheduling conflicts for employees — and

fines, penalties, and unforeseen costs for employers.

BE PROACTIVE WITH PREDICTIVE SCHEDULING COMPLIANCE

Prepare now to avoid potential compliance issues later. From advance notice, predictable pay, and on-call pay practices to reporting-time pay, split-shift pay, right to rest, and other legal provisions, the use of automated

scheduling helps schedule employees accordingly and accurately record all pay practices. In addition, automated scheduling improves the employee experience with more lead time to better balance work and life activities.

Automated solutions support meeting regulation requirements and your customer service needs while minimizing compliance risk.

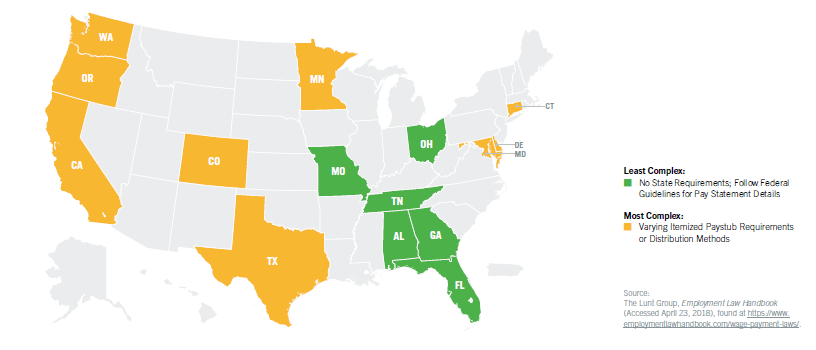

Wage Statements

Pay statement requirements could create compliance issues if your system isn’t flexible.

The federal government provides basic guidelines on information that needs to be recorded on an employee’s paycheck statement, but some states go beyond standard reporting requirements. Pay codes may need to be itemized by pay rate and pay type. Accruals may need to show not just accrued time taken to date but also accrued time earned to date,

or even a total of all hours worked.

Not only are there rules on what to include on the paycheck, but there also are rules, which can vary by state, on how to distribute paychecks and statements. Some may require a printed copy, even for employees who choose direct deposit and online review.

Your organization could be out of compliance if your payroll system doesn’t have the flexibility to manage pay components all the way through to the wage statement.

MEET VARYING WAGE STATEMENT REGULATIONS

Invest in HR and payroll software that is flexible enough to adjust to the needs of each state’s requirements. Having standard pre-configured pay rules and the ability to make adjustments as policies, rules, and laws change removes potential obstacles that could result in noncompliance. Every pay-related item also can be itemized on wage statements. For organizations that have operations in multiple states, meeting the requirements of the most complex state when building the configuration for all locations can reduce the impact of separate and/or duplicate coding and management.

Today, employees want access to their pay information when they want it, where they need it. Pay statements can be printed and distributed or simply made available online. Payroll solutions with mobile and employee self-service functionality meet these needs, so these requests can be fulfilled quickly

Navigating Regulations Made Easier

Moving into a new territory can be daunting when considering all these labor-related compliance regulations. This is all the more reason you need to be confident that your HR and payroll technology is flexible and robust enough to accommodate a variety of rules.

Our solution helps you navigate these rules and regulations with a standard, pre-configured compliance setup built to comply with each state’s requirements. Open a new location or expand a current location with ease. Save valuable time and effort and minimize your compliance concerns with our solution in your corner.