Integrated, automated tools that streamline payroll processing.

Control every step of your payroll process for better results

With Workforce Go! Payroll, you’re in complete control. No more time lost submitting work to a service bureau and waiting for them to check it. You can process payroll on your own schedule and complete special check runs such as commissions or bonuses without worrying about extra charges. And you get the flexibility to complete as many separate payroll runs as you need.

Get the information you need — when you need it

All payroll data is readily available through intuitive, highly configurable standard and ad-hoc reporting. Built-in tools make it simple to modify standard reports and to sort, group, filter, or customize report content for any time period. And Perfect Paycheck Analysis helps ensure calculation of the perfect paycheck while offering insights to inform next year’s budget planning.

Manage payroll complexity and make changes with ease

Easily manage and modify deduction and earning codes, direct deposits, tax jurisdictions, and other payroll elements so payments always reflect the latest information. View and edit employee payroll information individually or as a group using the mass edit feature. Change rates at any time during the pay period. And process employee wage garnishments with optimal timeliness and efficiency.

Empower employees with a convenient mobile app and self-service tools

Workforce Go! Payroll gives employees on-demand access to payroll information, including pay stubs and earning histories, through an easy-to-use mobile app and online self-service tools. Self-service also lets employees change direct deposit details, update W-4 forms, and even print W-2 forms. These tools empower employees to find and update information on their own so overworked HR and payroll administrators can focus on other tasks.

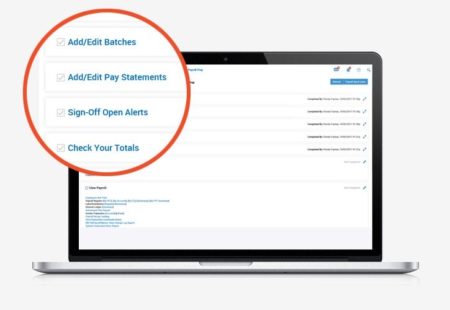

Workforce Go! puts you in complete control of your payroll.

Workforce Go! Payroll helps automate and streamline your entire payroll process and greatly reduces payroll processing time with configurable checklists and immediate access to reports and data. Starting with employee benefit deductions updated in payroll and accurate time data, you can ensure the perfect paycheck and reduce compliance risk.